For many, concentrated stock holdings are created through equity compensation from their employer. For others, it could be a stock they bought years ago or something they inherited. However the position was established, it is important to understand the complexities that come with these situations, both for the portfolio and the individual.

To start, let’s focus on those compensated in company equity. A frequently used form of incentive compensation are Restricted Stock Units (“RSUs”) which are designed to align compensation with company performance. Simply put, the better the company does, the better the stock does (or at least that is the most basic assumption). They also act as a retention mechanism, usually vesting over a multi-year period.

Some RSUs, however, may vest all at once at the end of a specified period, which is commonly referred to as “cliff vesting”. For those that have received RSUs, whether from one of the largest publicly traded companies or a privately-owned business, the potential for your wealth to grow is exponential.

Once the RSUs have vested and shares are transferred to one's brokerage account, the question then becomes how to thoughtfully diversify and avoid some of the investment biases we humans tend to exhibit?

How Do RSUs Work?

As a quick recap, when the RSUs vest, they are taxed as compensation income and subject to statutory withholding requirements. One common option afforded by most plans is to 'sell to cover' a participant's tax liability. This effectively means the company will sell just enough shares to cover the taxes due from vesting. For example, you had 400 shares of XYZ company vest at $10 per share. The company may sell 100 shares to cover your tax liability and you are now left with 300 shares at the $10 price. Your cost basis in this stock is now $3,000. If the stock goes up in value and you sell, your gains may be taxed at short- or long-term capital gain rates depending on your holding period. Anything held for more than a year (from date of vesting) will be taxed more favorably at long-term rates, where short-term capital gains are taxed at the ordinary income rate of the individual. As a result, tax avoidance is typically the primary driver for not immediately selling the stock and reinvesting in a more diversified portfolio.

Unexpected Risks with Concentrated Positions

It is important for those working at such companies to understand that their risk in owning the concentrated stock position is compounded by the fact that the company is also their employer. Simply put, if there was a material event within the company, or an external one for that matter, that negatively impacted the stock price and led to layoffs, the employee is at risk of not only losing their job, but also a portion of their accumulated wealth. We refer to a person’s career as their human capital and the value of their accounts as financial capital. When you combine human and financial capital, you are increasing the risk to your overall financial well-being.

Diversification should be considered to help reduce this increased risk. Stocks may rise rapidly, then never touch that price again, or remain stagnant for many years before moving upward, or a market leader may not reposition itself fast enough in a rapidly changing world.

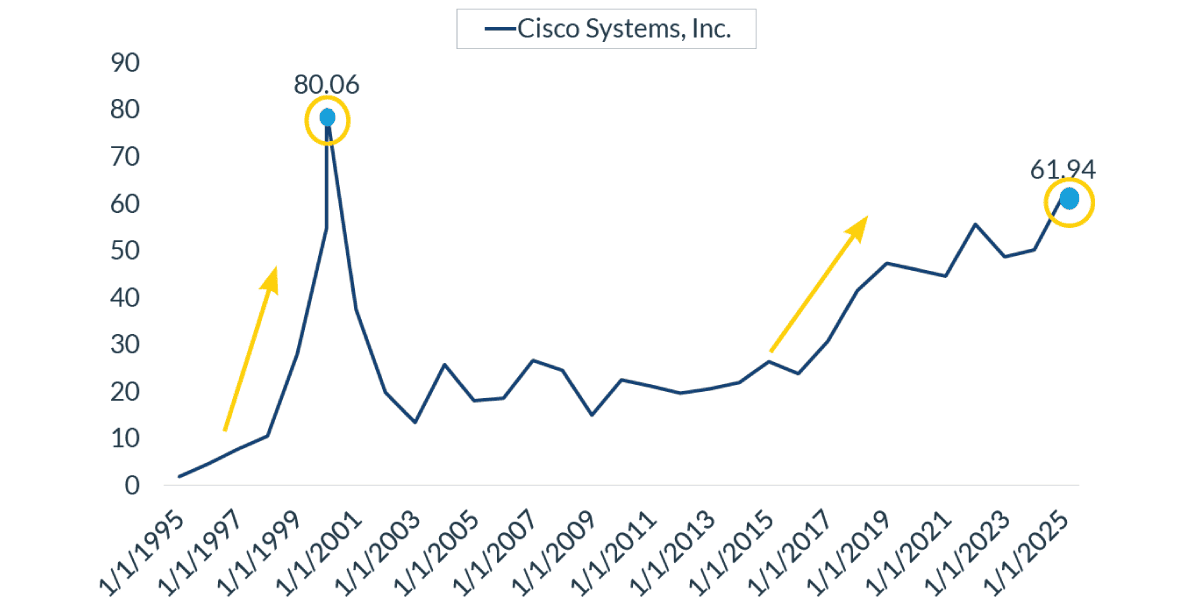

The following real-world cases provide examples of the unanticipated consequences investors experienced by holding on to concentrated positions of some of the largest companies in the world. (Exhibit 1)

EXHIBIT 1: Cisco Systems, Inc.

Source: Yahoo Finance as of February 12, 2025. For Illustrative Purposes Only.

Using Cisco Systems, Inc. (“CSCO”) as an example, (Exhibit 1) the stock has never again reached its all-time high that it touched in the year 2000, yet the company remains healthy with a successful business model.

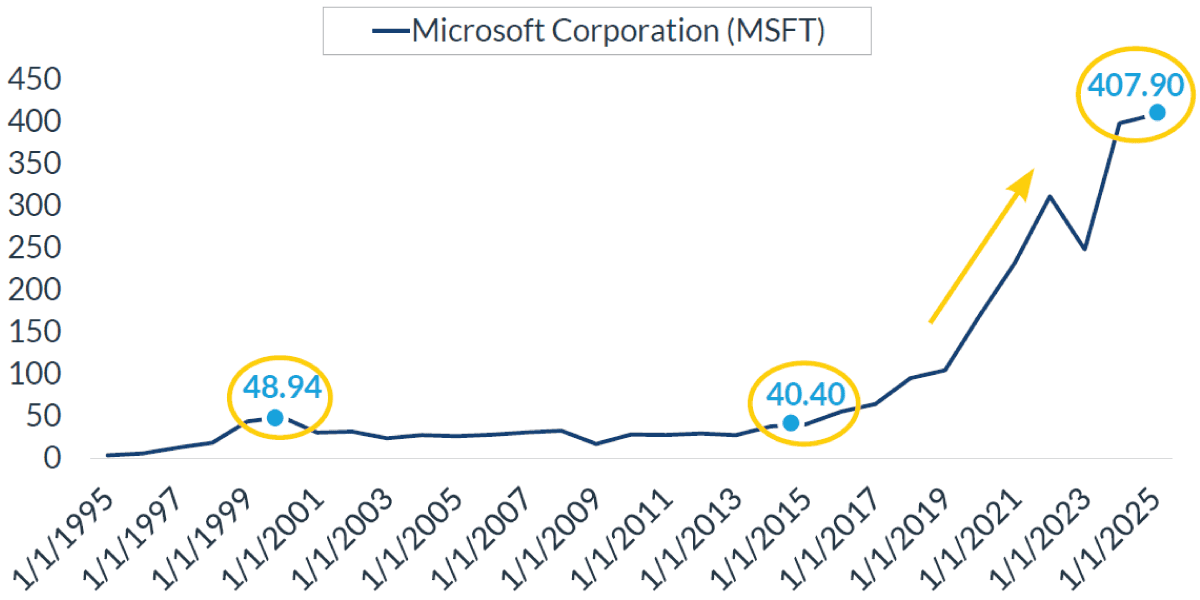

Other stocks have had long periods of stagnation before a run up. Microsoft (“MSFT”) is a perfect example of this. It took about 15 years to reach the price it touched in the year 2000, and since then has grown significantly. While this recent growth has rewarded investors’ patience, it is also a stark reminder that the recent growth trend may not continue at the same rate moving forward. (Exhibit 2)

EXHIBIT 2: Microsoft (“MSFT”)

Source: Yahoo Finance as of February 12, 2025. For Illustrative Purposes Only.

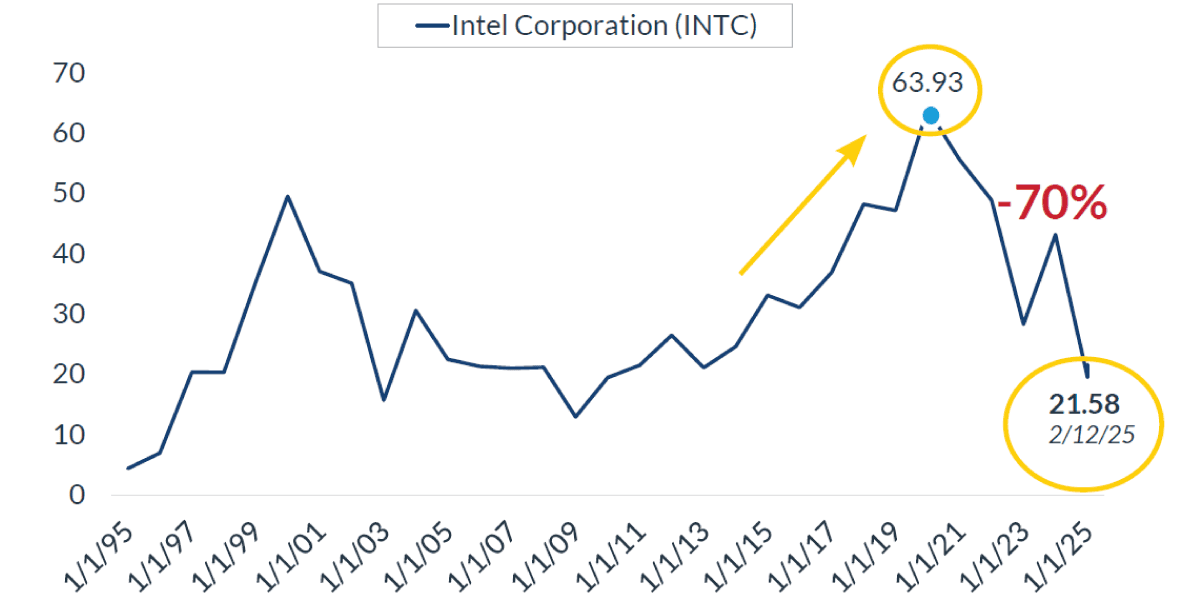

One last example as we explore exogenous risks or missed market opportunities that can drive a stock price downward is Intel Corp. (“INTC”). Intel Corp., a leading processing chip manufacturer for decades, has seen a 70% drop in its stock price since 2021, and has effectively missed the opportunity around GPU processing. Nvidia has skyrocketed passed the market capitalization of Intel, and there is the real possibility that some other company may surpass Nvidia somewhere down the road. All to say, we live in an innovative world where even market leaders can be left behind or “miss the boat”. (Exhibit 3)

EXHIBIT 3: Intel Corp. (“INTC”)

Source: Yahoo Finance as of February 12, 2025. For Illustrative Purposes Only.

Calling back to the risks of combining human and financial capital, not only has Intel’s stock price cratered, but the company has laid off more than 23,000 employees since the end of 2023.

Emotions around the Stock(s)

Those that work at these companies and have insight into the inner workings may feel like they know more than others and resist diversifying. They may also exhibit a Familiarity Bias, which is a tendency to invest and/or want exposure to things they are familiar with. Another emotion investors may be trying to avoid is regret.

They see today’s stock price, and if they sell and the stock significantly increases in value afterwards, they will feel as though they missed out. But just because a stock has grown significantly in value does not mean that growth will continue.

When we experience something, especially an event that has left a lasting positive impression, it is hard to envision the potential downsides. The same applies to a stock that has increased in value while an investor has held it.

Over time, even if the stock fundamentals do not warrant an investment, the investor may continue to hold the stock due to an endowment bias. This behavioral bias causes us to overvalue the stock, failing to recognize its true fundamental value. This bias can also be applied to those who have inherited stock from a loved one who has since passed on.

As humans, emotions can drive a lot of our decision making, and investing is no different. While these are just a few examples of some of the biases investors may have, there are many more. Working with a trusted professional can help investors identify these biases and help formulate a solution that addresses them.

Using Concentrated Positions for Planning Purposes

There are ways to use a concentrated position as part of your overall financial planning. One of those ways is to monetize the position as you work through your divestment plan. The most common way to this is to write call options on the stock you are holding. These are referred to as covered calls, given that you are holding the shares.

The goal of these would be to find a price, or prices, at which you are comfortably selling some shares, and write these call options, which gives the option buyer the right to buy the stock at those prices.

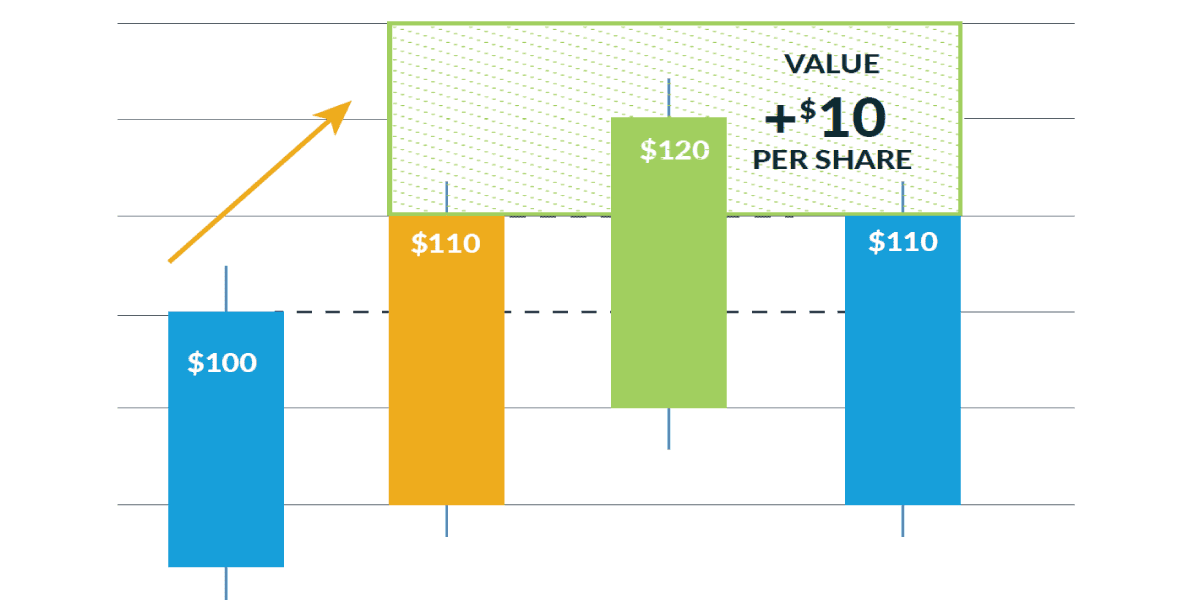

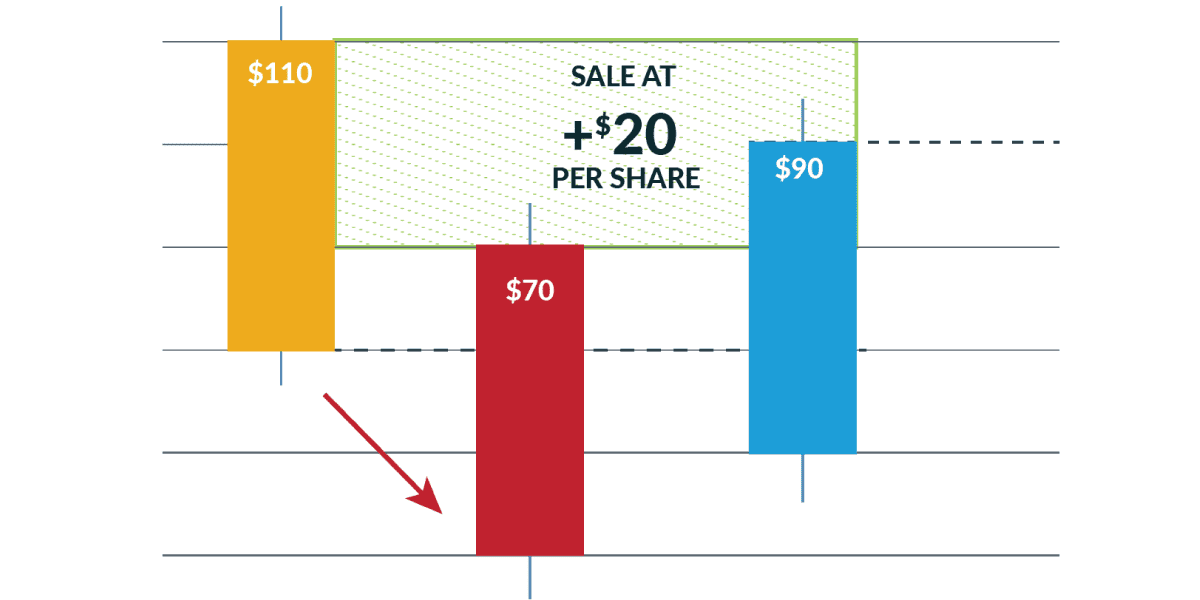

For example, if you are holding XYZ stock and it is trading at $100 per share, you can write call options at $110. If the stock price goes to $120 per share, the buyer of the call options has the right to buy the shares from you at $110. (Exhibit 4)

EXHIBIT 4: Concentrated Positioning for Planning

For Illustrative Purposes Only.

The option buyer has immediately benefited from buying the stock $10 below today’s price. In this example, you would have participated in the stock appreciation up to $110 and also received the premium the buyer spent to buy the call options from you.

A more advanced technique may be to not only write call options, but also buy puts, which creates a floor on the price of the stock.

This is commonly referred to as a “cashless collar” if executed correctly, where the call option premium received is used to buy the protective puts, thus not requiring a cash outlay (Exhibit 5)

EXHIBIT 5: Cashless Collar

For Illustrative Purposes Only.

Using the above example, you could take the option premium received on the $110 calls and buy $90 puts. If the stock falls to $70 a share, you have the right to exercise and sell the shares at $90. Protective puts are effectively insurance. It is important to highlight that options give the option buyer the right to exercise them; they are not mandated to. While buying insurance seems logical, investors rarely exercise the puts they buy, deciding to instead hold the stock and hope for recovery.

Therefore, simply selling the call options and pocketing the premium may be ideal for most. A bias related to this is the Anchoring Bias, where an investor has seen the stock touch a certain price and will hold onto it in hopes that it once again reaches that price.

Beyond options, concentrated positions with low-cost basis can be great tools for charitable planning. You could gift low-cost basis stock to a Donor Advised Fund, and potentially deduct the entire stocks value for tax purposes. This is much more optimal compared to selling the stock, paying the tax, and then gifting the net-of-tax cash to a Donor Advised Fund.

The downside of a Donor Advised Fund is that you no longer access any assets once they're contributed. If charitable planning is important to you, but you would like to maintain some access to the assets, a Charitable Remainder Trust (“CRT”) may be a better solution.

A CRT is an irrevocable trust that can receive low-cost basis stock. In return, the grantor receives a partial charitable deduction and annual distributions from the trust (typically for the rest of their life.) The annual distribution amount is a set percentage of trust principal and can be as low as 5% per year. The maximum distribution percentage is calculated based on the IRC 7520 Rate and the life expectancy of the beneficiary. For most people, this will fall somewhere between 8-15%. Keep in mind, the higher the distribution percentage selected, the lower the up-front tax deduction will be. There are other considerations when it comes to Donor Advised Funds, Charitable Remainder Trusts, and other charitable tools available to investors. Still, they should be considered and examined by those with charitable endeavors.

All to say there are ways to “use” the shares investors are holding for broader planning purposes, transitioning the conversation from “how will these shares affect my portfolio risk and returns?” to “how can I use these shares as part of a larger solution?”

If not aligned with charitable intentions, investors could even gift the shares to their children, assuming they are in a lower tax bracket, who could then sell the stock at a lower tax rate.

Summary

Owning one or more concentrated positions in a client portfolio can lead to out sized gains, but not without potentially significant volatility and risks to the investor. Over the years, there have been various solutions introduced to the market to solve this “problem”.

One of those solutions is an Exchange Fund*, where you can transfer your shares into a private fund, in turn receiving exposure to a broader range of stocks designed to mimic large indices. While this solution may seem attractive, they can be expensive, illiquid, and cause an investor to miss out on potential returns on the stock they are exchanging.

An Exchange Fund can be one of the many tools that may fit into your scenario, but it is important to remember that a comprehensive, personalized financial plan can help you piece together the bigger picture and formulate a solution that makes sense for you.

With the combination of a holistic financial planner and dedicated portfolio manager, clients can be assured that the divestment strategy is aligned with their overall financial plan today, and into the future.

CNR also has additional resources beyond investment professionals focused on broader tax and estate planning that can be value additive, with the ability to illustrate a number of scenarios. Please reach out to your financial advisor to better understand how CNR may be able to help you manage your exposure to concentrated stock positions.